People Claiming They Were Charged a Chash Back at Stores

The chargeback process is designed to increase consumer confidence — it's very easy for credit card users to dispute charges, while businesses and banks have to do all of the legwork to figure out whether or not a transaction is legitimate. From a business' perspective, however, chargebacks can often be a costly hassle.

The burden of proof to show that a customer has been rightfully charged falls on you, and when consumers successfully dispute charges, you lose both the product sold and the revenue from that sale.

Even when a dispute is unsuccessful, the acquiring bank will withhold payment for any chargebacks until the matter is resolved. Add in the fees charged by banks and processors, and even disputes which turn out in your favor can be expensive. This article aims to give more details about chargebacks, why they happen, and how you can prevent them.

- What is a Chargeback?

- Visa Chargeback Reason Codes

- MasterCard Chargeback Reason Codes

- The Chargeback Process

- Pre-Arbitration Advice

- Winning a Chargeback

- Preventing Chargebacks

- Chargeback Fees

- Chargeback Fraud

- Signature Removal and Chargeback Prevention

- Amex Temporary Chargeback Rule Updates (in effect til April 2018)

- Chargeback Management Companies

What is a Chargeback?

Chargeback is the term used when a customer disputes a charge on her credit card bill. Generally, chargebacks will happen for one of several reasons:

- A clerical error, such as a customer being double-billed or being billed for an incorrect amount

- Customer dissatisfaction, such as not receiving a product or receiving a product different than what was paid for

- A customer not recognizing a purchase, especially if the business name that appears on her bill differs from the actual name of the store

- Fraud — when a customer claims she did not authorize a purchase or a purchase was made as a result of identity theft

For most transactions, customers have 120 days from the sale or when they discovered a problem with the product to dispute a charge.

The bottom line here is that whenever customers feel that they have been charged for something they shouldn't have, they can file a dispute with their bank, which begins the chargeback process. The entire process will be detailed in the next section, but it's worth noting here that resolving these disputes can sometimes take more than two months — PayPal, for example, advises that the whole process can take up to 75 days. During this time, the revenue from the disputed sale is withheld from your account.

Whenever a chargeback is initiated, you'll receive a code from the issuing bank that gives a reason for the dispute. Some of the most common Visa and MasterCard chargeback codes are listed below. Once a customer has disputed a charge, a your acquiring bank will begin going through a specific procedure to resolve the issue.

Visa Chargeback Reason Codes

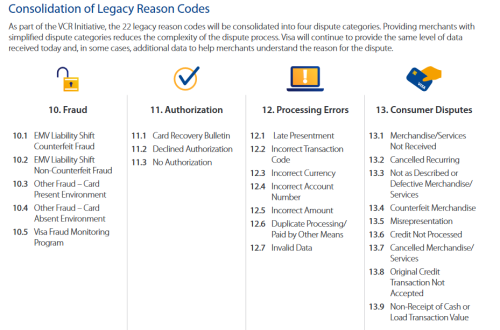

In 2018, Visa consolidated its list of reason codes into 4 categories: fraud, authorization, processing errors, and consumer disputes. This image shows how the previous reason codes are assigned in the new consolidated categories.

The individual codes are:

- 10.1: EMV Liability Shift Counterfeit Fraud

- 10.2: EMV Liability Shift Non-Counterfeit Fraud

- 10.3: Other Fraud – Card Present Environment

- 10.4: Other Fraud – Card Absent Environment

- 10.5: Visa Fraud Monitoring Program

- 11.1: Card Recovery Bulletin

- 11.2: Declined Authorization

- 11.3: No Authorization

- 12.1: Late Presentment

- 12.2: Incorrect Transaction Code

- 12.3: Incorrect Currency

- 12.4: Incorrect Account Number

- 12.5: Incorrect Amount

- 12.6: Duplicate Processing / Paid by Other Means

- 12.7: Invalid Data

- 13.1: Merchandise / Services Not Received

- 13.2: Cancelled Recurring

- 13.3: Not as Described or Defective Merchandise / Services

- 13.4: Counterfeit Merchandise

- 13.5: Misrepresentation

- 13.6: Credit Not Processed

- 13.7: Cancelled Merchandise / Services

- 13.8: Original Credit Transaction Not Accepted

- 13.9: Non-Receipt of Cash or Load Transaction Value

Mastercard Chargeback Reason Codes

Mastercard continues to have a long list of possible reason codes, as follows.

- 4802: Requested/Required Information Illegible or Missing

- 4807: Warning Bulletin File

- 4808: Requested/Required Authorization Not Obtained

- 4812: Account Number Not On File

- 4831: Transaction Amount Differs

- 4834: Duplicate Processing

- 4837: No Cardholder Authorization

- 4840: Fraudulent Processing of Transactions

- 4841: Cancelled Recurring Transaction

- 4842: Late Presentment

- 4846: Correct Transaction Currency Code Not Provided

- 4847: Requested/Required Authorization Not Obtained and Fraudulent Transaction

- 4849: Questionable Merchant Activity

- 4850: Installment Billing Dispute

- 4853: Cardholder Dispute—Defective Merchandise/Not as Described

- 4854: Cardholder Dispute—Not Elsewhere Classified (U.S. region only)

- 4855: Goods or services not provided

- 4857: Card-Activated Telephone Transaction (fraud only)

- 4859: Change to Addendum, No-show, or ATM Dispute

- 4860: Credit Not Processed

- 4862: Counterfeit Transaction Magnetic Stripe POS Fraud

- 4863: Cardholder Does Not Recognize—Potential Fraud

- 4870: Chip Liability Shift

- 4871: Chip/PIN Liability Shift

The Chargeback Process

Once a customer initiates a chargeback, the issuing bank sends the transaction in question back to your acquiring bank — effectively reversing the sale. The cardholder's account is credited for the amount of the transaction, and your account has the funds from the sale in question withheld until the matter is resolved.

Every acquiring bank has its own specific procedure for handling chargebacks, but they're all governed by the framework set up by the card brand. Acquiring banks will generally let you know exactly what's expected, and it's important to follow these procedures to the letter to protect your chargeback rights. Discover, for example, prohibits businesses from contacting customers who have disputed a transaction.

Another VERY important note: a customer's bank will refund the balance of a disputed transaction as soon as the customer initiates a chargeback. You should NOT refund the customer on your own!

Acquiring banks deduct the amount of the disputed transaction from your account, at which point it's up to you to either accept the chargeback or to plead your case. At this stage, and in most cases (unless the business has violated the terms of service of their card association), you will be able to present evidence to the acquirer proving that the transaction in question is legitimate. The evidence required will be dependent upon the reason for the chargeback. If this evidence convinces the acquiring bank that a customer was rightfully charged, the acquirer will submit the transaction to the issuing bank a second time.

At this point, the issuing bank will either agree with the acquirer and reject the cardholder's dispute or disagree, in which case you can either accept this outcome or send the transaction to the card association for final arbitration. If the card association decides in your favor, the cardholder will be billed for the appropriate amount and you will receive payment. If the decision goes in the cardholder's favor, the cardholder will retain the credit already issued by her bank and you will not be paid for the amount of the transaction.

If any products were delivered, you will have to accept the loss of that good or service as well. Again, the banks and the card association take care of moving all the money during the chargeback process — if a customer's dispute is upheld, you should not issue a refund. Likewise, if you win the chargeback dispute, you should not bill the customer a second time — you will be paid for the original transaction by the acquiring bank.

12B Letters

Some companies, like First Data, refer to a retrieval request as a 12B letter. A retrieval request (or 12B Letter) is one of the first steps in the overall chargeback process. During a retrieval request, the issuing bank (the bank that issued the customer's card) will contact the acquirer for more information about the disputed transaction.

Retrieval requests incur a fee each time they occur, and the costs vary by processor. In your CardFellow quotes, the fee will be listed as "Retrieval Fee" under the heading "Per-Occurrence Fees."

Note that retrieval fees are different than chargeback fees. If the dispute progresses from the retrieval request stage to the chargeback stage, you'll typically also incur a chargeback fee. Many processors charge a smaller fee for retrievals than chargebacks.

Pre-Arbitration Advice

If you dispute a chargeback initially and the issuing bank sides with the cardholder, you'll likely receive a notice called Pre-Arbitration Advice (if the transaction was made with a Visa card) or a 2nd Chargeback letter (if the transacation was made with a Mastercard.) This letter will inform you that the bank has initially sided with the cardholder and asks if you'd like to pursue final arbitration directly with the credit card company. You can choose to decline arbitration, which will mean that the chargeback is upheld, or you can choose to pursue arbitration, where the credit card company will determine who wins the chargeback. Arbitration with the credit card company is final – once it makes a ruling, there are no further appeals. Additionally, going to the card brands for abritration usually incurs a filing fee of several hundred dollars. (This fee is separate from the amount of the disputed transaction.)

There's no one right answer when responding to a pre-arbitration notice. Determining whether to pursue arbitration or decline in the pre-arbitration phase is a situation-specific decision. You'll need to assess the pros and cons for your business if and when the situation arises.

Read more about what happens when you get a chargeback.

Chargeback Fees

Unsurprisingly, the process outlined above costs merchants money in the form of chargeback fees, and businesses have to pay regardless of whether or not they win the dispute.

First up is the nominal fee charged for retrieval requests. These requests are made by issuing banks when a cardholder asks about or disputes a charge. Processors vary on what they charge, but this fee tends to fall in the range of $5-15.

If the information obtained in a retrieval request does not satisfy a customer or the customer's issuing bank, the dispute moves to a chargeback and you'll be hit with a chargeback fee. You have to pay the chargeback fee even if the cardholder's claim is rejected, and even if the chargeback is a result of fraud or identity theft. This fee can range from $15 — 40.

As mentioned in the section above, if you take a dispute to the arbitration stage, you risk paying in the neighborhood of $400 in various fees to the card brand.

On top of all of these fees, both Visa and MasterCard have a strict limit on the total number of transactions that can be charged back before additional fines and penalties are levied. A business whose chargebacks exceed a 1% (Mastercard) or 0.9% (Visa*)of its total sales volume (the dollar amount, not the number of transactions) becomes subject to a chargeback monitoring program administered by the card brand, which is accompanied by a $5,000 fine. At this point, there is a very good chance that the account will simply be terminated by the bank or credit card processor.

*As of October, 2019.

Preventing Chargebacks

With the cost associated with chargebacks, businesses should take steps to protect themselves. Here are some simple steps that can help prevent chargebacks:

- Respond Quickly

Respond to retrieval requests and chargebacks promptly. Banks will simply process a chargeback if you don't respond to the dispute in the allotted time. - Deliver Great Customer Service & Clearly Post Return Policies

Make it as easy as possible for customers to get customer service, and make the return policy clear at the time of the transaction. Many customers will go to a business to resolve a dispute first, only initiating the chargeback process if they cannot get assistance or a refund. A direct refund to a customer is always less expensive than if a customer wins a chargeback. - Swipe Cards When Possible

Card-present businesses can prevent chargebacks by requiring that cards be swiped, and get a signature whenever possible. This makes it easier to prove that the cardholder is the one using the card — so easy that, beginning in April, Visa will reject chargebacks with certain fraud reason codes if the card was electronically read. - Use Address Verification Service (AVS)

Consider using the Address Verification Service anti-fraud tool. AVS works by comparing a customer's name, address, and zip code with the information on file at the credit card company. Mismatches can indicate that transactions should be declined or that you should proceed with caution and require additional information. Matches indicate a greater likelihood of a valid transaction. - Obtain CVV/CVC Codes

Another suggestion to prevent fraud is to require customers to enter the 3 digit security code on the back of their card when ordering products online. This helps to ensure that the person using the card has the physical card in hand and has not stolen an account number. - Use Verified by Visa & MasterCard SecureCode

One more step to prevent fraudulent online purchases is to take advantage of Verified by Visa or MasterCard SecureCode — both programs that require customers to enter a password when using a card online. - Communicate

Communicate with customers. If customers know the status of their orders, they will be less likely to dispute a charge. - Ensure Truth in Advertising

Advertise honestly and have clear terms of service — these can prevent customers from disputing transactions because the product they purchased was not as described. - Avoid Technical Errors

Take measures to avoid clerical or technical errors. Visa provides an excellent list of suggestions here. - Abide by Card Association Regulations

Follow the terms of service set by the card brands. Any compliance violation can cause a merchant to lose its chargeback rights.

Chargeback Fraud

In addition to the prevention measures outlined above, you should be aware of chargeback fraud and how to protect themselves. One of the fastest growing types of chargebacks is what's known as "friendly" fraud — when consumers purchase products with the intent of initiating a chargeback in order to get free merchandise.

The person committing the fraud will often claim that a product was not delivered, was not as described, or that they simply did not order a product. Especially since the recession, this type of fraud is on the rise, and is prevalent for card-not-present transactions. Check out our article on friendly fraud for a thorough explanation and steps you can take to protect yourself and your business.

Unfortunately, chargebacks are one of the "costs of doing business" when accepting credit cards. However, by taking steps to ensure that customers are informed and satisfied with their purchases, and putting measures in place to prevent credit card fraud, merchants can greatly reduce exposure to chargeback risk — and all of the accompanying costs.

Signature Removal and Chargeback Prevention

In the spring of 2018, all for major card brands announced the removal of signature requirements for credit card transactions. Businesses no longer need to collect customer signatures at the time of a transaction. While signed receipts weren't a guarantee of success in fighting a chargeback, they were often one piece submitted as evidence. Some businesses wonder what impact signature removal will have on chargebacks, or even question if they should continue to collect signatures.

We spoke with Chargebacks911, a risk mitigation firm that helps online merchants optimize profitability through chargeback management. Co-founder and COO Monica Eaton-Cardone offered insight into the change.

How does the removal of signature requirements impact chargeback defense?

It seems like removing the signature requirement for a card transaction would make chargeback defense harder at first glance, but it probably won't have a big impact, to be honest.

Signatures were already a very lax security method, and they were used inconsistently. Some [businesses] are strict about verifying signatures, but most are rather inconsistent. Even then, the signature was never an airtight piece of evidence for a chargeback, so cutting that requirement won't take away much from the current situation.

The chip-and-PIN method, which is already in place in other markets outside the US, is much more effective as a fraud prevention tool than a signature.

What documents can a business provide to fight a chargeback now that they may not have a signed receipt?

Unfortunately, there's not really a single "silver bullet" that will work in every situation; evidence needs to be tailored to the case at hand. If you're shipping an item, for example, then delivery confirmation and asking customers to sign for high-ticket purchases can be one of your best pieces of evidence. But, in brick-and-mortar transactions that don't involve shipping, you'll need to get more creative. You could use photos of the customer in possession of a product, or records of email conversations with the customer.

Can a business still choose to require a signature from cardholders even though it's not required by the card brands?

Yes; [businesses] can still choose to collect signatures to verify transactions if they want. Of course, signatures are still mandatory for any [businesses] who haven't yet upgraded to chip card reader, too.

Amex Temporary Chargeback Rule Updates

In June 2016, American Expressed announced temporary updates to its rules about chargebacks. Effective from the end of August 2016 until April 2018, businesses will not be liable for fraudulent counterfeit Amex transactions under $25.

By the end of 2016, Amex also plans to limit the quantity of chargebacks for which a business can be held liable. The plan for the end of 2016 is that a business can only be liable for the first 10 chargebacks on any given card. Cardholders can still dispute fraudulent transactions, but the liability will fall to the issuer (not the business) for any chargeback over 10.

These new rules will be in place until April of 2018 and are designed to help businesses avoid drains on their cash flow so that they can upgrade to EMV chip card processing equipment.

Winning Chargebacks

If you do win a chargeback, Eaton-Cardone says that the standard procedure is that you'll receive the funds back automatically, less the chargeback fee. As for timing, she adds, "The funds should be released right away, with the only real delay being the time required to work through the ACH transaction clearing process."

Chargeback Management Companies

While businesses can technically dispute chargebacks and manage the process themselves, there are companies that offer to do it for you. Costs and services provided vary by company, but if you get a lot of chargebacks, aren't familiar with the dispute process, or would just prefer professional help when dealing with chargeback issues, it may be worth your time to look into chargeback management services. We have an article on what to expect, what to ask about, and more. Check it out here: Considerations When Choosing a Chargeback Management Company.

People Claiming They Were Charged a Chash Back at Stores

Source: https://www.cardfellow.com/blog/chargebacks/

0 Response to "People Claiming They Were Charged a Chash Back at Stores"

ارسال یک نظر